portland oregon sales tax rate 2020

There is no applicable city tax or special tax. You can print a 725 sales tax.

Portland OR Sales Tax Rate.

. The company conducted more than 200. 54 Taxable base tax rate. The County sales tax rate is.

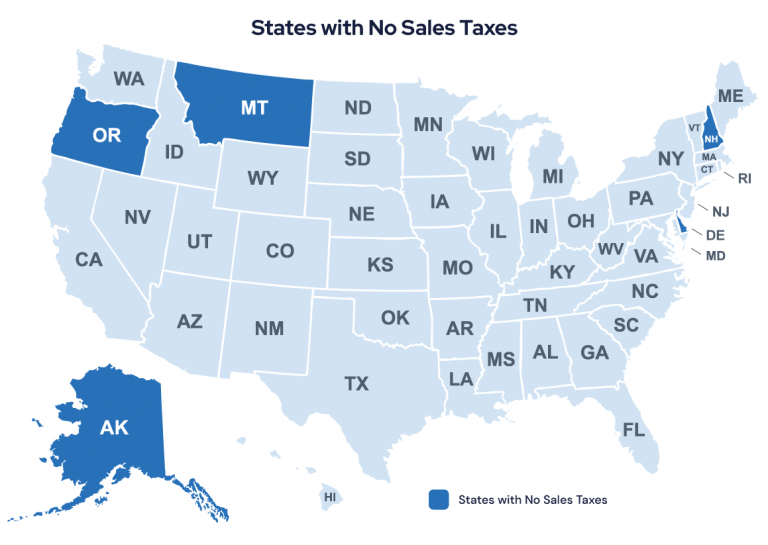

This is the total of state county and city sales tax rates. The Oregon state sales tax rate is 0 and the average OR sales tax after local surtaxes is 0. The state sales tax rate in Oregon is 0000.

Oregon cities andor municipalities dont have a city sales tax. In 2019 and 2020. The rate was reduced to 145 in 1993 when the City and County achieved code conformity and.

The minimum tax would be in addition to the 100 minimum tax. The latest sales tax rate for Portland MO. Sales tax region name.

The minimum Heavy Vehicle Use Tax due for a tax year is 100. For example under the South Dakota law a company must collect sales tax for online retail sales if. This rate includes any state county city and local sales taxes.

2022 Oregon Sales Tax Table. Nor Portland Oregon impose any state or local sales taxes. Portland Tourism Improvement District Sp.

Oregon cities andor municipalities dont have a city sales tax. In 2019 and 2020 Portland and Oregon will impose new gross receipts taxes. 2020 rates included for use while preparing your income tax deduction.

Exact tax amount may vary for different items. The Portland Oregon sales tax is NA. 2020 rates included for use while preparing your income tax deduction.

The 925 sales tax rate in Portland consists of 7 Tennessee state sales tax and 225 Sumner County sales tax. Please complete a new registration form. Combined with the state sales tax the highest sales tax rate in Oregon is NA in the cities of Portland Portland Salem Beaverton and Eugene and 102 other cities.

What is the sales tax rate in Portland North Dakota. The oregon sales tax rate is currently. The companys gross sales exceed 100000 or.

This is the total of state county and city sales tax rates. Tax rates last updated in January. Combined with the state sales tax the highest sales tax rate in Oregon is NA in the cities of Portland.

There is no applicable city tax or special tax. The minimum combined 2022 sales tax rate for Portland North Dakota is. Some rates might be different in Portland.

The Portland sales tax rate is. Sales Tax Calculator Sales Tax Table. Oregon Sales Tax Oregon does not collect sales taxes of any kind at the state or.

Rates include state county and city taxes. A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the. The Oregon sales tax rate is currently.

This rate includes any state county city and local sales taxes. The minimum combined 2022 sales tax rate for Portland Oregon is. 2020 rates included for use while preparing your income tax deduction.

The sales tax jurisdiction name. Taxfilers must file their business tax returns and pay their business tax liability at the same time they file their federal and state income tax returns. The December 2020 total local sales tax rate was also 0000.

2022 Oregon state use tax. What is the sales tax rate in Portland Oregon. Business Tax Return Filing Requirements.

Compare sales tax rates by city and see which cities have the highest sales taxes across the United States. To this end we show advertising from partners and use Google Analytics on our website. The Portland sales tax rate is NA.

The 725 sales tax rate in Portland consists of 575 Ohio state sales tax and 15 Meigs County sales tax. Capital gains tax rates on most assets held for less than a year correspond. The OR use tax only applies to certain purchases.

Over the years the tax rate has increased from 6 in 1976 to 146 in 1992. Oregons sales tax rates for commonly exempted categories are listed below. 2022 Oregon state sales tax.

The Oregon use tax is a special excise tax assessed on property purchased for use in Oregon in a. The Clean Energy Surcharge CES and the Corporate Activity Tax CAT respectively. For the tax years beginning on or after January 1 2020 this tax is 3 percent of the total Oregon Weight-Mile Tax calculated for all periods within the tax year.

States With Highest And Lowest Sales Tax Rates

Why Does Sales Tax Vary From State To State Quora

Sales Tax By State Is Saas Taxable Taxjar

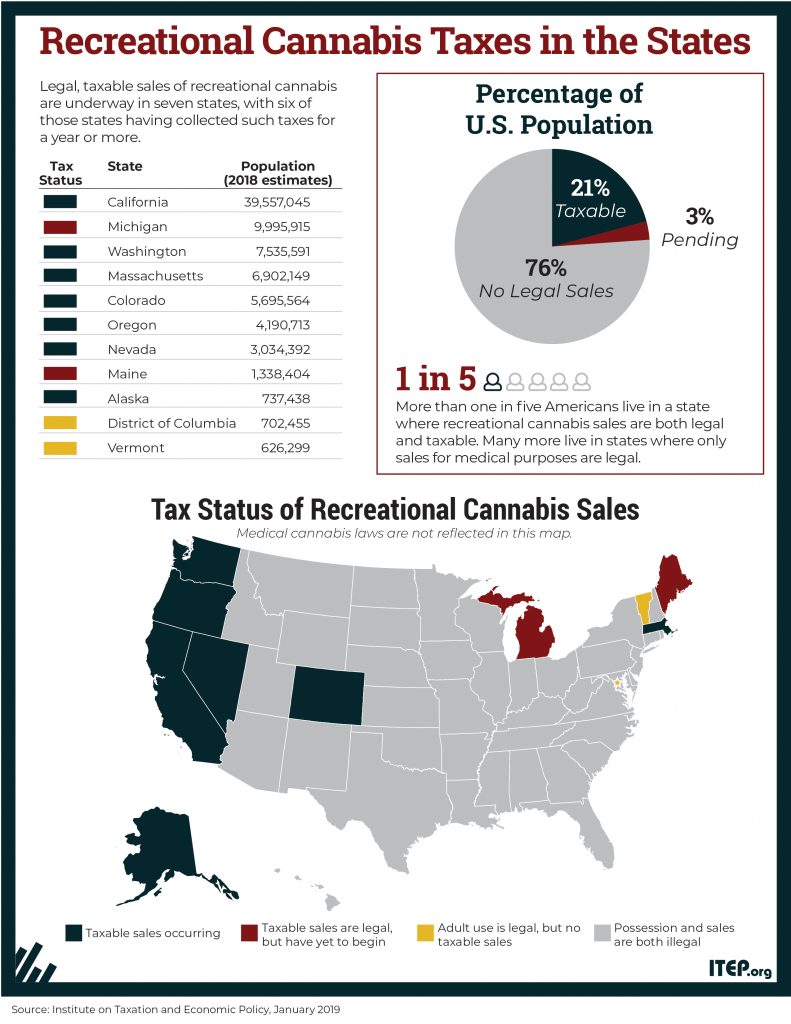

Higher Local Sales Tax On Cannabis Weighed In Oregon Legislature Portland Business Journal

Sales Taxes In The United States Wikiwand

Sales Taxes In The United States Wikiwand

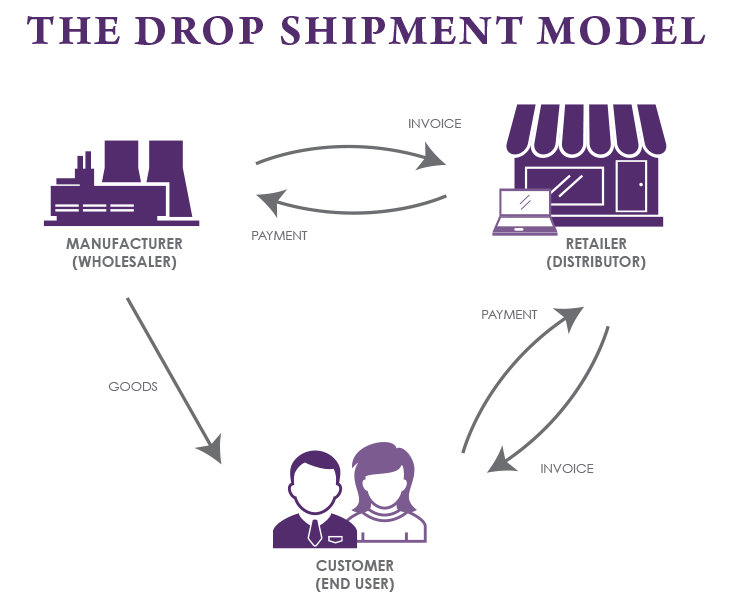

How Do Drop Shipments Work For Sales Tax Purposes Sales Tax Institute

Everything You Need To Know About Restaurant Taxes

A Guide To The Best And Worst States To Retire In

What Is The Harris County Sales Tax The Base Rate In Texas Is 6 25

Sales Tax Rates In Major Cities Tax Data Tax Foundation

Sales Taxes In The United States Wikiwand

Sales Taxes In The United States Wikiwand

Montana Tax Information Bozeman Real Estate Report

Historical Oregon Tax Policy Information Ballotpedia

New Sales Tax Rules For Oregon Residents Overturf Volkswagen